I’ve been chasing the dream of living a location independent life since my days in the Peace Corps. I’ve wanted the freedom to live and work in parts of the world where people wouldn’t even bother to go for vacation. I’ve dreamt of the freedom to do anything I want, and not have to worry about how much money it yields. In fact, people toss around the word PASSION all day long among my millennials. But honestly, I don’t know what mine is, because I’ve never allowed myself to really think about it. My Asian upbringing immediately labels any vocation with a dollar sign.

And so, with all that dreaming, I somehow find myself living in the same city for the longest duration of my entire adult life, approaching 5 years. I needed an exit plan.

I spent the first 3 years in Shanghai turning that atrociously negative net worth positive. Since, I’ve had more breathing room to think about the next step. About 10 months ago, X and I put our Excel skills to good use, and modelled out that exit plan. Unlike most financial independence blogs, I don’t want to get into the exact dollar amount, but instead want to simply highlight the concept.

Our model is based on the 4% rule. It goes like this:

- Determine the annual expenses you need x 25 = the amount you need to save by Freedom Day (FD). This becomes your goalpost.

So, if you anticipate living out your freedom in cities like San Francisco and New York, where monthly expenses could be $5k, then you need $5k x 12 x 25 = $1.5M by FD.

But, if you anticipate hanging out on the beaches of Thailand, living on $1k a month forever, then you’d only need $1k x 12 x 25 = $300k by Freedom Day.You see how the goal post changes? There is no ONE number to reach. It simply depends on how you want to live your life. We are somewhere in the middle of those two extremes. If you don’t know how much you spend in a month, then that’d be the very fist step to take.I’ve meticulously noted money leaving my bank account every month since I arrived in Shanghai, so I have a decent idea of how much I need. Note that I said amount of money leaving, not a budget. I don’t believe in budgets. I don’t believe in tracking how much I spend in coffee. I love Starbucks. - Once you have the goalpost, then let a savings model show you the magic. Use a savings calculator to determine how much you can save, and what % of return you think your investments would make. We use the average stock market return of 7% (the basis of 4% rule).

- The model then will give you an end date. Clearly, that date depends on how much you can save each month, and how conservative you are in your investments. I transferred that model into Excel so I can make graphs, charts, and totally geek out.

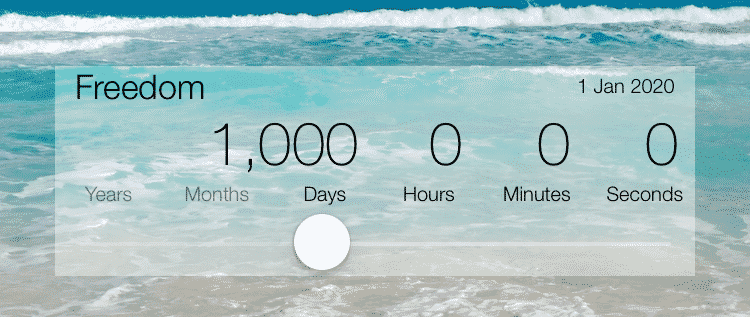

This provides a solid starting point, and our nifty model told us we could reach Freedom by January 1, 2020. Now, this is not guaranteed, of course. I can’t help it if a financial crisis happens next year (*knocks on wood*). If that happens, then we will modify our plan accordingly. Furthermore, the 4% rule applies to people who want to retire, and not work another day in their life. I know my brain cells would simply not allow that, so I am not too worried if we don’t arrive at the exact figure. A close enough ballpark will do.

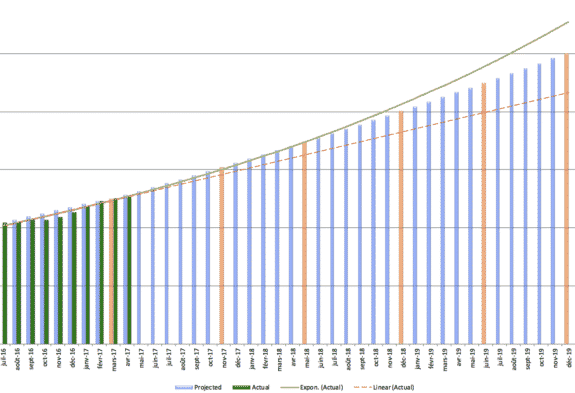

Below is our chart. So far we are on track. I must admit the most exciting day of each month is now updating our chart!

The bars are what the estimated net worth should be. I highlighted some bars in orange as shorter-term goal posts. The green line indicates the return growing exponentially based on our inputs, and the red dotted line indicates the amount we would have if we didn’t increase our savings per month.

The countdown has long ago begun, and recently it reached the 1,000 day mark. I’m excited to share this journey with the world, and keep ourselves accountable. If you’d like to learn more about any part of what I’ve discussed in this post, please leave a comment, and I’d be happy to elaborate in a separate post!

4 thoughts on “1000 Days to Freedom”